What is in the water that many, too many, landlords drink? What can they be thinking? The same can be said (though not as often) about tenants, and we will do so. What is in the water that many, too many, tenants drink? What can they be thinking?

What is in the water that many, too many, landlords drink? What can they be thinking? The same can be said (though not as often) about tenants, and we will do so. What is in the water that many, too many, tenants drink? What can they be thinking?

The subject is asking for money rightfully owed to those drinkers. It might be for taxes or it might be for operating expenses, percentage rent, insurance premiums, reimbursable expenses or refunds for the payment of any one or more of those. It might even be for other things such as overdue rent. Yes, why do rightfully billable charges or rightful claims go unbilled or unclaimed until years later when someone wakes up, often, but not always, a successor landlord or tenant?.

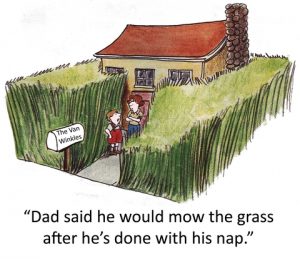

[If you] SNOOZE, you [can] LOSE. “Do not spend your days gathering flowers by the wayside, lest night come upon you before you arrive at your journeys end, and then you will not reach it. [Isaac Watts].

If you haven’t experienced the situation or been asked about the following situation yet, it is just that you haven’t been at this real property leasing thing long enough: After “X” years (“X” often being 5 or more) of failing to bill a tenant for taxes or other monies genuinely owed, a landlord sends out a (BIG) bill. Both the tenant and its landlord turn to trusted advisors and ask: “How far back can the landlord go and still have the right to collect what is owed?”

The answer is clear: it depends. It depends on what the lease says; it depends on which state’s law applies; it depends on what that state’s law says; and, it depends on a number of other things, often seemingly innocent ones, that took place before the long overdue bill is mailed.

Before anyone gets all bent out of shape, here’s where Ruminations stands. If someone is legitimately owed money, she, he (or it) should get paid. It doesn’t matter how long it takes before a demand (or request) for payment is made. Yes, if it is owed, it is owed.

BUT, that’s not all Ruminations thinks. We think it isn’t fair to wait too long before asking for your money. At some point such claims should be in the “old and cold” category. A tenant, and it is almost always a tenant, should be able to close its books. The owners of small tenants should comfortably be able to spend the money that is “left over” after known expenses. Large tenants should be able to close their budgets and use their experiences to make future plans. Bonuses have been paid based on “profit.” Financial reports have been filed. Dividends have been distributed.

For the landlords out there, here’s a truism. If you don’t bill “additional rent” items promptly, you are not going to get the 100% cost recovery you are entitled to receive. Tenancies will have changed. You’ll see more audits. Some tenants just plain won’t have the money. Others just won’t want to pay. And, none of that has to do with the concept of the “time value of money.” You could have had the money and used or otherwise invested it.

Worst of all, landlords (and sometimes, tenants), you may lose the RIGHT to collect the money.

Though Ruminations has not done a jurisdiction by jurisdiction search, we still have confidence in this answer to our original question – “How far back can the landlord go and still have the right to collect what is owed?” Basically, that would be the “statute of limitations” in the applicable jurisdiction. If you aren’t familiar with the legal niceties of that term, your intuition will serve you well. There are details, such as when you start counting the (usually 4 to 6 year) deadline, but the common thread is that once the “statute” has run, you can’t get a court to legally enforce your monetary claim. It’s a little more complicated than that, but readers should have a huge expectation that moneys owed from long ago will be lost.

There’s more that’s not good about waiting. You could lose the right to collect monies “fresher” than the “limitation” period. You could lose the right to collect some charges for all time. Yes, it is possible that with the passage of time, a delinquent biller can be found to have “waived” the (otherwise rightfully) owed charges. In some cases, failing to send out bills, combined with some other events, can be interpreted as an actual amendment to the lease, one that eliminates the payment obligation for the rest of the lease term. If the tenant’s financial condition has deteriorated over time, a bankruptcy may come into play.

There is another, maybe dominant, factor at play – the psychological one. People don’t like to give money back once they think it was theirs to keep. If a bill is timely rendered, the recipient hasn’t yet established an “entitlement” to the money. Wait five years and then send the bill, that’s a whole other ball of wax.

Here’s a story from North Dakota that will illustrate just how a landlord lost money by waiting too long. To be fair, it might not have been entitled to the money in the first place but, if that was the case, its tardiness put the nails in the coffin. To see the December 8, 2016 decision we read from the United States Court of Appeals for the Eighth Circuit, click: HERE.

Before we get to how the court “punished” the landlord for waiting too long, we feel compelled to address yet another example of how ambiguity kills. Take a look at the following prolix text:

Notwithstanding anything contained in this Lease to the contrary, Tenant shall pay no more than the amount set forth in Article 1(L) as Initial Estimated Monthly Center Expenses for the first twelve (12) months of the Term and thereafter the amount Tenant is obligated to pay on the annualized basis for Center Expenses for any one Lease Year shall not exceed the lesser of the following: (i) the actual amount of Tenant’s Proportionate Share of Center Expenses computed in accordance with Article 28, or (ii) the amount of Center Expenses payable by Tenant for the immediately preceding Lease Year increased by five percent (5%). . . . The cap on increases in Center Expenses provided for herein shall not apply to the portion of Center Expenses for utility charges, Taxes and snow removal and, therefore, the maximum permitted increase in the amount which Tenant is obligated to pay on an annualized basis for Center Expenses, as hereinbefore provided, shall be based on the Center Expenses net of the portion thereof for utility charges, Taxes and snow removal.

[Fortunately, the warring parties agreed that the reference to Article 1(L) was intended to be a reference to Article 1(I).] Article 1(I) told us:

Initial Estimated Monthly Center Expenses: $ N/A.

The landlord’s position was that the two piece of lease text we’ve reproduced add up to: (a) it couldn’t bill for “Center Expenses” for the first 12 months of the lease’s term; and (b) it could do so later.

The tenant’s position was that it would never be liable for the payment of Center Expenses.

Ahh! – Ambiguity.

“N/A” means “not applicable.” According to the appellate court, “[a] rational person could interpret ‘Initial Estimated Monthly Center Expenses: $ N/A’ to mean the tenant didn’t owe Center Expenses for the first 12 months of the lease.” But, “a rational person could [also] interpret Article 1(I)—located at the beginning of the lease, and a ‘Basic Provision’ of the lease—as saying that Center Expenses are not relevant to [the tenant’s] obligations at all.” The court went on to say:

Had Article 1(I) said “$0,” it would clearly indicate an introductory reprieve from Center Expenses liability. But saying “N/A” potentially indicates a permanent exemption.

If any reader wants to see how the court weighs these two arguments, that reader will have to look at the decision itself, starting on its eighth page. For today’s purpose, we’ll jump right to how the court resolved the ambiguity it found. Regular readers know that where an ambiguity is found courts resolve them by looking for the “intent” of the parties. One key tool is inherent in this tool:

The parties’ conduct in the course of performance after the contract’s formation can help determine the meaning of ambiguous language.

How did that play out before this particular court? Well, the tenant offered two pieces of evidence. First, over the first 10 years of the lease, neither the landlord nor its predecessor ever charged the tenant for “Center Expenses.” What could be the effect of such non-action? Here is the court’s explanation:

This suggests that the parties intended Article 1(I)’s “N/A” to exempt [the tenant] from Center Expenses liability: A commercial landlord has incentives to collect money its tenants owe. Thus, [the landlord] and its predecessors’ decision not to collect Center Expenses from [the tenant] suggests they understood the language of the lease to impose upon [the tenant] no obligation to pay for Center Expenses.

Second, six years earlier, the landlord sent the tenant an estoppel certificate stating that the tenant’s “Monthly CAM Expenses” were “N/A/ mo.” The certificate said that the tenant had an obligation to pay rent, taxes, and percentage rent, but not “Center Expenses.”

How did this play out? Well, here’s what this particular court thought (and ruled):

Together, the course of performance and estoppel certificate strongly support that “Initial Estimated Monthly Center Expenses: $ N/A” means that Gap has no obligation to pay Center Expenses for the duration of the lease.

Most, if not all, other courts would have ruled the same way.

Did we say, “If you snooze, you (could) lose?” Well, that was our authority for saying so.

Another point: Tenants – in most cases (not the one in this court’s decision) – know the landlord should be billing them and that they will owe the money. So, why not ask for the bill? If the deal was that you would pay for your share of certain expenses, that was the deal. Taking advantage of “Lady Luck” isn’t a good or fair business plan.

One last observation. There is a way to avoid the long and expensive process of having a court (and then an appellate) court figure out what the parties intended in the first place. The lease can handle this issue.

Very often, tenants with bargaining power insist on the right to audit their landlords’ additional rent charges (common area or operating expenses, taxes, insurance premiums, etc.). Why there is any fight over this puzzles us. If there were a court fight over the accuracy of those charges, the tenant would get that right as part of the litigation process. Even with a time limit in the lease for the “audit right,” the agreed-upon time limit would not bar a tenant, in litigation, from digging back even earlier.

What we don’t see very often at all, is a cut-off time for the underlying claim. Merely cutting off an audit right does not affect the time within which the underlying charges can be billed. Given that landlords and tenants really should ask for what they are owed, and do so on a timely basis, why not establish a “private” statute of limitations? It can apply to bills or percentage rent or refunds. Leases are written in too many ways for us to be able to provide definitive, usable (suggested) provisions. So, we’ll leave readers with a piece of sand from which pearls might grow. Think about the concept behind something like: “Landlord waives its right to be paid any part of an Operating Expense if it does not send Tenant a bill for such Operating Expense by the end of the third calendar year following the year in which such Operating Expense was first incurred or paid, whichever is earlier, by Landlord.” A variation of that could be written to bar a tenant from claiming an overpayment for an improperly billed (and paid) earlier charge,

What do you think?

In every lease in which my tenant has an obligation to pay operating expenses or common area maintenance charges, we are always successful in securing an audit right. However, most commonly, landlords insist that there will be a very short timeframe associated with that audit right and they commonly resist the idea that my client might have the right to reach back to previous years. In my experience, if the charges are incorrect, the error is most normally in favor of the landlord.

What I find distasteful is that a landlord will insist that he have the right to reach back and anytime in the future for charges Owed by a tenant for which the landlord had not previously rendered a bill. But when it comes to the tenant having the right to reach back in the common area audit, the landlord is unwilling to offer a reciprocal right.

Ira, Your suggestion is fair. However, when a Landlord’s failure to bill a Tenant for a particular service is due to the Landlord’s failure to receive the underlying invoice from the service provider, then, in that case, the Landlord’s entitlement to reimbursement from the Tenant should NOT be forfeited.

I appreciate the information given in this article about the rental property and the factors which a landlord should consider while making an agreement with the tenants. Management of the rental property is really difficult and hence it is really essential to hire property management professionals for the management of the rental property. Such professionals also act as an interface between the tenants and the landlords. Besides, they deal with the issues associated with the rental property which not only saves a lot of money but also save a lot of valuable time.