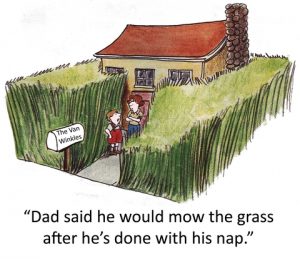

A common question we get (or see) has to do with very, very late billings for taxes or common area charges. Though one would think that a landlord would be anxious to send timely, periodic bills, for some reason, some don’t. If any reader can explain the advantage a landlord gets by sending a bill for three years of charges in one fell swoop, please do so. Otherwise, we’ll continue to think it’s crazy. If nothing else, tenants and leases turn over. Go chase a tenant whose store or even whose business closed years earlier. [Read more…]

A common question we get (or see) has to do with very, very late billings for taxes or common area charges. Though one would think that a landlord would be anxious to send timely, periodic bills, for some reason, some don’t. If any reader can explain the advantage a landlord gets by sending a bill for three years of charges in one fell swoop, please do so. Otherwise, we’ll continue to think it’s crazy. If nothing else, tenants and leases turn over. Go chase a tenant whose store or even whose business closed years earlier. [Read more…]

I Just Got A Tax Or CAM Bill Three Years Late

What’s In A Name: Gross And Net Leases

Gross vs. Net Leases. Rent is the dominant continuing connection between a landlord and a tenant. Almost always, all expenses arising out of real estate development are paid by tenants – taxes, insurance, maintenance and other operating costs, environmental costs, and the rest. These costs may already be included in the initial rent. In such a case, unless the lease is for a very short term, the tenant will thereafter separately pay the amounts by which taxes, insurance premium, and maintenance costs increase over the “base year” cost of those items. The base year is almost always the first year of the lease term. So, it doesn’t matter if the initial rent has already taken into account the then current taxes, insurance premiums, and maintenance costs or whether it doesn’t. When they are included, the rent is higher and the tenant only pays subsequent cost increases – that’s called a “gross” rent lease. When the rent doesn’t included these initial “pass-through” expenses, the tenant will pay, as “additional rent,” its entire share of the cost for taxes, insurance, and maintenance over and above the seemingly lower rent. Leases employing this latter approach are frequently referred to as some form of “net” lease – “triple net” (NNN), “absolute net” or “net.” Unfortunately for the inexperienced practitioner, those terms (and similar ones like them) mean little because, from their “nickname” alone, they cannot tell who is responsible for paying the costs to fix the building’s structure or flooring or items of similar character. As a result, it is imperative that anyone preparing a lease find out “who pays for what.” [Read more…]

Gross vs. Net Leases. Rent is the dominant continuing connection between a landlord and a tenant. Almost always, all expenses arising out of real estate development are paid by tenants – taxes, insurance, maintenance and other operating costs, environmental costs, and the rest. These costs may already be included in the initial rent. In such a case, unless the lease is for a very short term, the tenant will thereafter separately pay the amounts by which taxes, insurance premium, and maintenance costs increase over the “base year” cost of those items. The base year is almost always the first year of the lease term. So, it doesn’t matter if the initial rent has already taken into account the then current taxes, insurance premiums, and maintenance costs or whether it doesn’t. When they are included, the rent is higher and the tenant only pays subsequent cost increases – that’s called a “gross” rent lease. When the rent doesn’t included these initial “pass-through” expenses, the tenant will pay, as “additional rent,” its entire share of the cost for taxes, insurance, and maintenance over and above the seemingly lower rent. Leases employing this latter approach are frequently referred to as some form of “net” lease – “triple net” (NNN), “absolute net” or “net.” Unfortunately for the inexperienced practitioner, those terms (and similar ones like them) mean little because, from their “nickname” alone, they cannot tell who is responsible for paying the costs to fix the building’s structure or flooring or items of similar character. As a result, it is imperative that anyone preparing a lease find out “who pays for what.” [Read more…]

Old And Cold – Audit Rights And Claim Cut-Offs

Is there a time to let old things die? We are qualified to answer that question when it comes to matters emotional, but when it comes to “business,” Ruminations only has some thoughts. Today, we’ll discuss chasing people who owe money but, because money isn’t everything, we’ll start with a little digression intended to make a point.

Is there a time to let old things die? We are qualified to answer that question when it comes to matters emotional, but when it comes to “business,” Ruminations only has some thoughts. Today, we’ll discuss chasing people who owe money but, because money isn’t everything, we’ll start with a little digression intended to make a point.

How long should the government (that’s us, by the way) be permitted to chase a criminal? Many (but not all) states have laws that answer that question. Here’s New York’s answer:

6 years for felonies punishable by 8 or more years in prison

3 years for felonies punishable by less than 8 years in prison

No limit for murder or other capital offenses.

Three years for misdemeanors committed against children 13 and younger.

One year for other misdemeanors.

Though the time limit to file civil claims also varies by state and by the type of claim being made, they also butt up against time limits. Typically, general contract claims must be made within 6 years after the claim can first be made. Claims arising out of the sale of goods have a 4 year limit. Tort claims (and automobile accidents fall in that category) typically have a two or three year limit. Some defamation claims have an even shorter limit – only one year. Unsurprisingly, claims against government entities often have shorter time limits. After all, “Whoever has the gold makes the rules.” [Read more…]

PrintHow Can We Get Out Of Here In One Piece? (Part 1)

Vacation time and the living is easy. Ruminations has a big backlist of material and sometimes we cheat by reaching into it and putting an edited, usually lightly edited, version of “stuff from the vault” in the form of a blog posting. That’s what’s happening this week and at least next week. Just like a resale store, “it’s new to you.” [That is, new to at least nearly all, but not all, of our readers.] Today, tour approach adds up to the first part of a primer, from the Ruminations perspective, on assignment and subletting.

Vacation time and the living is easy. Ruminations has a big backlist of material and sometimes we cheat by reaching into it and putting an edited, usually lightly edited, version of “stuff from the vault” in the form of a blog posting. That’s what’s happening this week and at least next week. Just like a resale store, “it’s new to you.” [That is, new to at least nearly all, but not all, of our readers.] Today, tour approach adds up to the first part of a primer, from the Ruminations perspective, on assignment and subletting.

Under common law, absent a lease restriction, tenants were free to assign their leasehold interest to others or to sublet all or part of their leased space. That rule of law is of little consequence today because virtually all leases restrict assignment and subletting rights, often in excruciating detail. In addition, a small number of jurisdictions have reversed the rule by statute and there are certain kinds of leases, generally tied into personal services that are not, as a default matter, freely assignable. [Read more…]

PrintAdditional Rent Is No Rent At All

We are aware that in New Jersey, if a lease doesn’t denominate a particular tenant’s financial obligation as some version of “rent,” then the landlord can’t get the tenant evicted for non-payment of that item. The reason we are aware of this is because we’ve seen case law that denies a landlord such relief. While the landlord can sue to collect such charges, for example, common area charges, it can’t evict the tenant if the lease doesn’t say that such charges are “rent” or “additional rent.” It doesn’t matter that Ruminations thinks that’s just plain silly. That’s the way it works even if everyone other than the court knows that such items are part of a tenant’s rent.

We are aware that in New Jersey, if a lease doesn’t denominate a particular tenant’s financial obligation as some version of “rent,” then the landlord can’t get the tenant evicted for non-payment of that item. The reason we are aware of this is because we’ve seen case law that denies a landlord such relief. While the landlord can sue to collect such charges, for example, common area charges, it can’t evict the tenant if the lease doesn’t say that such charges are “rent” or “additional rent.” It doesn’t matter that Ruminations thinks that’s just plain silly. That’s the way it works even if everyone other than the court knows that such items are part of a tenant’s rent.

Nonetheless, since courts, not Ruminations, get to issue eviction documents, almost all New Jersey leases recite something like: “All monies required by this Lease to be paid by Tenant to Landlord constitute ‘Additional Rent’ and the failure to pay Additional Rent will have the same consequences as failure to pay Basic Rent.” Still, some New Jersey leases don’t say anything like that but, fortunately, almost all tenants actually pay their rent (and additional rent). So, you don’t see a lot of court decisions about the issue. [Read more…]

PrintShopping Centers Are Like Health Care

There may be a connection between our national health care (insurance) policy and our industries’ approach to back-charging for common area expenses (operating costs) and real estate taxes. Oh, come on – isn’t this a craven attempt on the part of Ruminations for topical relevance? Read on and judge for yourself.

There may be a connection between our national health care (insurance) policy and our industries’ approach to back-charging for common area expenses (operating costs) and real estate taxes. Oh, come on – isn’t this a craven attempt on the part of Ruminations for topical relevance? Read on and judge for yourself.

Wikipedia provides as good an explanation of “community rating” as one will find anywhere. For its relatively short entry on the subject, click: HERE. For those who don’t want to leave the page, take a look at this:

Community rating is a concept usually associated with health insurance, which requires health insurance providers to offer health insurance policies within a given territory at the same price to all persons without medical underwriting, regardless of their health status. [Read more…]

PrintWhat Does Difluoromonochloromethane Mean To Landlords And Tenants?

Today, Ruminations will seem to be discussing difluoromonochloromethane. Though it might seem that way, we’re actually using it as a proxy for a more general “suggestion.” But, that will need to wait.

Today, Ruminations will seem to be discussing difluoromonochloromethane. Though it might seem that way, we’re actually using it as a proxy for a more general “suggestion.” But, that will need to wait.

Difluoromonochloromethane has been a remarkably useful chemical compound. If you know about it at all, you probably know it as “R-22.” If you do, then you can skip right over the next sentence. R-22 is a hydrochlorofluorocarbon-based refrigerant used in about half of this country’s commercial air conditioning systems. If has some other, less common, uses but when it comes to HVAC, it is “king.” Down the road, however, it will be abdicating its office. The process began a number of years ago, but the closer we get to 2020, the clearer this will be.

This refrigerant is an ozone-depleting substance. Regardless of any reader’s position about climate change or global warming, no one thinks that destroying atmospheric ozone is a good thing. So, 30 years ago, following a series of meetings in Montreal, lots of countries, the United States included, signed an international treaty. To implement that treaty, those countries, including the United States, embarked on separate programs to end the use of ozone-depleting substances.

Here’s a short translation of what the United States did with respect to R-22 starting in 1993. Manufacture or import of equipment using R-22 refrigerant after 2009 was banned. Production or import of R-22 is banned after 2019. [By the way, by 2030, the entire class of chemical compounds known as hydrochlorofluorocarbons will no longer be manufactured in, or imported to, the United States. [Read more…]

PrintYou Snooze; You Lose; Maybe; Probably

What is in the water that many, too many, landlords drink? What can they be thinking? The same can be said (though not as often) about tenants, and we will do so. What is in the water that many, too many, tenants drink? What can they be thinking?

What is in the water that many, too many, landlords drink? What can they be thinking? The same can be said (though not as often) about tenants, and we will do so. What is in the water that many, too many, tenants drink? What can they be thinking?

The subject is asking for money rightfully owed to those drinkers. It might be for taxes or it might be for operating expenses, percentage rent, insurance premiums, reimbursable expenses or refunds for the payment of any one or more of those. It might even be for other things such as overdue rent. Yes, why do rightfully billable charges or rightful claims go unbilled or unclaimed until years later when someone wakes up, often, but not always, a successor landlord or tenant?.

[If you] SNOOZE, you [can] LOSE. “Do not spend your days gathering flowers by the wayside, lest night come upon you before you arrive at your journeys end, and then you will not reach it. [Isaac Watts].

If you haven’t experienced the situation or been asked about the following situation yet, it is just that you haven’t been at this real property leasing thing long enough: After “X” years (“X” often being 5 or more) of failing to bill a tenant for taxes or other monies genuinely owed, a landlord sends out a (BIG) bill. Both the tenant and its landlord turn to trusted advisors and ask: “How far back can the landlord go and still have the right to collect what is owed?” [Read more…]

Print

Recent Comments