What is in the water that many, too many, landlords drink? What can they be thinking? The same can be said (though not as often) about tenants, and we will do so. What is in the water that many, too many, tenants drink? What can they be thinking?

What is in the water that many, too many, landlords drink? What can they be thinking? The same can be said (though not as often) about tenants, and we will do so. What is in the water that many, too many, tenants drink? What can they be thinking?

The subject is asking for money rightfully owed to those drinkers. It might be for taxes or it might be for operating expenses, percentage rent, insurance premiums, reimbursable expenses or refunds for the payment of any one or more of those. It might even be for other things such as overdue rent. Yes, why do rightfully billable charges or rightful claims go unbilled or unclaimed until years later when someone wakes up, often, but not always, a successor landlord or tenant?.

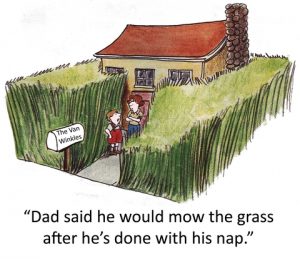

[If you] SNOOZE, you [can] LOSE. “Do not spend your days gathering flowers by the wayside, lest night come upon you before you arrive at your journeys end, and then you will not reach it. [Isaac Watts].

If you haven’t experienced the situation or been asked about the following situation yet, it is just that you haven’t been at this real property leasing thing long enough: After “X” years (“X” often being 5 or more) of failing to bill a tenant for taxes or other monies genuinely owed, a landlord sends out a (BIG) bill. Both the tenant and its landlord turn to trusted advisors and ask: “How far back can the landlord go and still have the right to collect what is owed?” [Read more…]

Print

Recent Comments