A few weeks ago, we wrote about the distinction between “rights” and “remedies,” but in somewhat theoretical or even esoteric terms. Today, we’ll present a situation that demonstrates a practical intersection of the two. Our story comes from an April 24, 2020 decision from the Appellate Division of the Supreme Court of New York. [That’s New York’s name for its intermediate appellate court.]

A few weeks ago, we wrote about the distinction between “rights” and “remedies,” but in somewhat theoretical or even esoteric terms. Today, we’ll present a situation that demonstrates a practical intersection of the two. Our story comes from an April 24, 2020 decision from the Appellate Division of the Supreme Court of New York. [That’s New York’s name for its intermediate appellate court.]

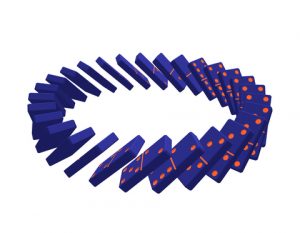

Imagine a mall with approximately 150 tenants. One of those tenants (and possibly others) was listed as a “Named Retail Tenant” or as a “Suitable or Successor Replacement Anchor Store,” a “Required Tenant” or “Upscale Tenant” in the “co-tenancy” provisions within the leases of many other tenants at the mall. Basically, if this “Named Retail Tenant” left the mall, dominos could fall.

Imagine, also, that this “Named Retail Tenant’s” lease included a kick-out clause wherein if that tenant’s “gross sales” fell below a stated amount, it could terminate its lease. In particular, “gross sales” were defined to include:

… the total gross sales prices of any and all merchandise . . . in all cases whether said sales . . . are for cash or credit or otherwise, and without reserve or deduction for inability or failure to collect.

The lease included “17 specific exclusions and deductions, such as sums collected for taxes, returns, and refunds.” “Promotional discounts” were not one of the seventeen.

When the tenant elected to terminate its lease, asserting that its sales at the mall fell below the threshold in its lease, the landlord had an audit conducted. Its accountants identified about $900,000 in “promotional discounts” that had not been included in the tenant’s gross sales report.

So, who was right? Was a “promotional discount” part of the “gross sales price” of an item? Don’t expect an answer to that question. The court didn’t reach that question, though two dissenting justices flatly stated that the discounts should have been included. Frankly, we don’t even understand what kind of “discount” was at issue. Was it the common “20% off” sign that has become a permanent feature of product pricing? Was it a discount coupon? Actually, it doesn’t matter because the crux of the problem was that the definition used, not an unusual one, invited this dispute. How does one interpret “gross sales” when the definition uses those same words and relies on “prices” not “sales”?

Not unexpectedly, the tenant asserted that gross sales meant the amount actually received by it. Thus, because it never receives promotional and other discounts, those weren’t to be included. Its landlord countered that the tenant was conflating gross sales with net sales. It argued that gross sales meant the “grand total of the sales transactions before the deduction of sales allowances, discounts, or returns.”

Can any reader objectively say that the landlord was crazy? After all, the lease’s definition of “gross sales” relied on “prices.” Yes, Ruminations knows about the argument to be made along the lines of, “But, everyone knows that’s not what they meant. No one would expect that “sales” would ever exceed “revenue.” It’s industry practice, etc.” But, we in the industry don’t get to sit as judges. And, here, two appellate court judges (in dissent), flatly stated: “Thus, pursuant to the unambiguous language of the lease, promotional discounts must be included in the calculation of defendants’ gross sales.” Granted that the judges in the majority didn’t say that – all they did was send the issue back to the lower court. To us, that’s not great comfort and it is why we think “gross sales” should relate to revenue, i.e., “the total amount realized as the result of sales of merchandise and services made by” a tenant and its concessionaires, sublessees, and licensees in the leased premises. This could be written as follows (then followed by exclusions or specific examples):

“Gross Sales” means the actual revenue, in the form of cash or as a receivable, from the sale or rental of any and all goods, wares, and merchandise sold, leased, licensed or delivered and the actual charges for all services performed by Tenant or by any subtenant, licensee or concessionaire in, at, from or arising out of the use of the Leased Premises, whether resulting from wholesale, retail, cash, credit, trade-in or other transactions, without reserve or deduction for any inability or failure to collect such revenue.

Revenue is revenue. Accounting standards and tax rules make revenue readily auditable. If a landlord thinks that “revenue” understates “gross sales,” then negotiate for a lower threshold.

More importantly, let’s write our documents to say what they mean, and mean what they say. If “promotional discounts,” whatever they are, will be included as part of “gross sales,” then say so. You’ll need to go down the rabbit hole and define “promotional discounts.” That may require you to define terms used in that definition, and so on. If you go through that exercise, you might better appreciate the more precise concept of “revenue.”

Now, for the second lesson from this New York shopping mall case. Assuming that the landlord’s interpretation is correct or, at a minimum has a good chance of being correct in the mind of a court, what remedy does it have against this tenant? Can it force the tenant to stay open or just seek monetary damages?

Well, as is commonly the case, the majority found that even if the landlord’s position passed scrutiny, the landlord had not established “that it would sustain irreparable injury without a preliminary injunction” (to bar the tenant from closing its store). According to those judges, it was an “anodyne” proposition that:

Irreparable injury, for purposes of equity, . . . mean[s] any injury for which money damages are insufficient. … Thus, where “any loss of sales [caused] by the allegedly improper conduct of [the tenant] can be calculated,” a [landlord] has an adequate remedy in the form of money damages and is not entitled to injunctive relief.

[It had been a “month of Sundays” since we last saw “anodyne” used. It means: not likely to provoke dissent or offense; inoffensive, often deliberately so.”]

Apparently, the lease contained a liquidated damages provision specifying certain money damages if the tenant closed its store. Thus, the court ruled:

because the lease specifically provides that [the landlord] is entitled to certain money damages in the event that [the tenant] vacate[s] the premises in breach of the agreement—the very injury that serves as the predicate for [the landlord’s] action—we conclude that [the landlord] has an adequate remedy at law and, moreover, that [the landlord] has not suffered irreparable harm because the liquidated damages clause was intended as the sole remedy for such a breach.

Now, that result is not surprising. It is the mainstream result in these disputes. In the rare case where a court orders a tenant to stay open. It only happens, and not often even: where the tenant is clearly the lynchpin at a property, and “everyone” understood the inevitable consequences of a vacancy, including that no reasonable calculation of monetary damages would ever be possible. There isn’t a lot of case law where such injunctions have been sustained, certainly not on a permanent basis. So, landlords, don’t count on getting a court to order that a tenant will stay open. If that’s the remedy you want, then to get a shot at success, your lease should say that the tenant agrees to injunctive relief for this particular circumstance, i.e., the wrongful cessation of business.

Key tenants, you aren’t off the hook. In any given circumstance, a judge could find “irreparable” harm, the key to a landlord obtaining injunctive relief. That’s what the dissenting judges would have done. They understood the domino effect of co-tenancy failures and would have upheld the lower court’s order requiring the tenant to stay open pending determination of the “gross sales” issue. As the dissenting judges saw it, the landlord had “sufficiently demonstrated that the premature termination of [the] lease [would] cause a loss of goodwill and damage to [the landlord’s] customer relationships that [would] not be remedied by an award of liquidated damages and thus that temporary injunctive relief [would have been] appropriate.”

Again, a lease is like a ball of molding clay. The parties can shape it to reflect the result they agree-upon. Yes, it takes talent, but that’s what our readers have. The issues raised in this court’s decision [one that can be seen by clicking: HERE] are common ones. Our leases can be molded to avoid or minimize them. Let’s all try to do so.

Hi Ira: A couple of years ago I was an expert witness representing a major retailer on the identical issue. We lost that case based on the court’s application of the rules of contract construction regardless that the result was that the tenant could not only not terminate but it had to pay percentage rent on amounts it never received! As the landlord was a local developer in that jurisdiction, I assumed the court was corrupt. Since then I have enlarged the gross sales exclusions to make it clear that gross sales means only the sums actually received. Also, I created a new exclusion for “markdowns”, i.e. discounts for any reason. As the philosopher Miradoux once said, “No poet ever interpreted Nature as broadly as a lawyer interprets the Truth”.

I believe that is Giraudoux quote.

If, as you say, Ira, “gross sales” should sensibly relate to what a tenant actually receives, why not start using the phrase, “gross revenues,” or even “gross receipts,” instead? One would still need to specify the exclusions, but at least in the event of a dispute the plain language used would relate to what Tenant actually received, not a theoretical concept of “sales,” which could include or exclude all kinds of regular or sale discounts.